Two Arbitrage Investments in Crypto, Part I: Mt. Gox Bitcoin Claims

Assessing a special situations opportunity in crypto

As readers may know, I find arbitrage opportunities very interesting. I got my start in crypto arbitraging the price differences among exchanges in 2017.

I want to highlight two current arbitrage opportunities in crypto that readers may find interesting — the Mt. Gox claims and the Grayscale BTC discount. This post will focus on the Mt. Gox claims.

Mt. Gox Bitcoin Claims

In early 2020, a friend set up a SPV to buy Mt. Gox bitcoin claims. Here is a rundown of the opportunity, as presented to me:

Mt. Gox was the largest bitcoin exchange in the world when it was hacked in 2013. A Russian hacker stole ~600–850k bitcoin. Mt. Gox subsequently filed bankruptcy in 2014. For every bitcoin a person held at Mt. Gox, they received a claim if they filed an application with the Tokyo District Court (the court overseeing the Mt. Gox bankruptcy).

We are paying ~$900 for each Mt. Gox bankruptcy claim. When the claims are paid in 1–3 years, we will receive $784 cash (minus $25-$50 in additional legal fees), plus 0.15 Bitcoin and 0.15 Bitcoin Cash (about $1450 in value today). In total, we’re getting over $2,000 of value for $900.

The $16 billion lawsuit from CoinLab is the last remaining hurdle to Mt. Gox exiting its bankruptcy proceedings. Anyone in the industry can tell you that this lawsuit is bogus. The damages contract between CoinLab and Mt. Gox was capped at $50 million, which would reduce the cash value of the claims by $62. Our team estimates there would be $25–50 per claim in additional legal fees if the bankruptcy lasts another 3 years.

To summarize:

Bitcoin & Bitcoin Cash go to zero, and bankruptcy expenses/settlements are severe → we get 80% of our money back.

Bitcoin & Bitcoin Cash stay where they are, and bankruptcy expenses/settlements are severe → we get ~$700 in cash + $1300 from the Bitcoin & Bitcoin Cash, and make a 100% gain net to LPs after all fees.

Bitcoin rises in price. If Bitcoin doubles from $9500 today to $19000, the claims would be worth ~$3500 apiece (0.15 * $19000 + $700 of cash). Since we’re buying the claims at $900, that would be a 186% return net to LPs after all fees instead of a 100% return from buying Bitcoin at spot.

Additional info:

Bitcoin was trading around $9500 at this time.

The Mt. Gox trustee had recovered ~200,000 BTC of the lost Mt. Gox BTC, of which ~60,000 BTC was sold across time for a cash buffer.

The first sign to me that this opportunity was legitimate was that Fortress Investment Group, a prominent asset manager, was buying Mt. Gox claims since 2019. In addition, see here, here and here for how Fortress adjusted their offers over time pending BTC price movements and updates on the situation.

What I liked about this opportunity was that it was 1.5x leveraged on BTC on the upside, with great protection (80%) on the downside. Of course, to keep in mind was the hard-to-quantify risk in the Coinlab lawsuit, or the chance that the payout gets dragged out, or payout never occurs.

Validating the Opportunity

First, I checked that there was skin in the game. My friend had put in seven-figures into the trade personally and through his fund, which was a good sign. They had been able to source the claims for their own position, and saw capacity to obtain up to $25–45M worth of claims.

I checked with a few other sources, including getting in touch with those who held Mt. Gox claims, to get second-hand confirmation of the opportunity.

Then I double checked the financials.

On page 15, paragraph I.1, it shows 69,397,600,922 Yen in the estate. Appendix 2 on page 22 lists the number of approved claims at 802,521. Divide the two to get $784 in cash per claim.

Page 15 paragraph I.2 says 141,686 BTC and 142,846 BCH. Page 22 has 802,521 approved claims. 141,686/802,521 = 0.17655 BTC per claim (and approximately that amount of BCH).

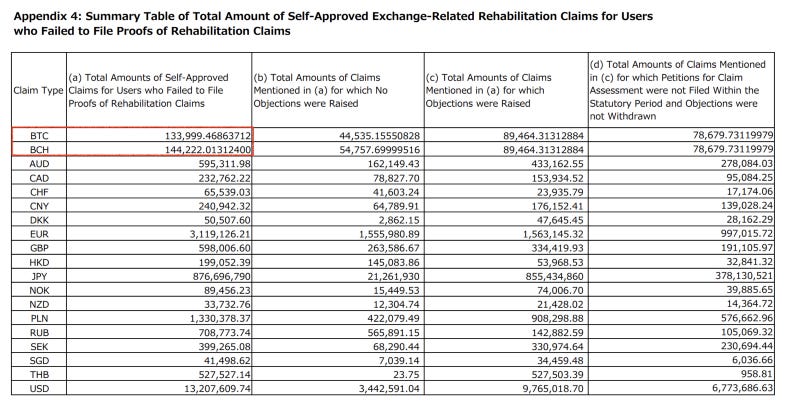

On page 24, there are additional claims that are pending:

If you add these potential “additional claims” to the pile of 802,521 approved claims, you get to 936,520 BTC claims. With 141,686 BTC in the estate, this is 0.15 BTC per claim on a diluted basis.

Unclear areas

Where I was uncertain was the cash portion of the claim. As outlined in red in the first photo, there are 751M claims on the JPY portion. If this number used instead of the 802K bitcoin claims, the cash portion of the payout would be negligible (69B yen / 751M claims = <$1 USD aka negligible, VS 69B yen / 802K claims = $784 USD). This is also in line with this article which stated that Fortress offering $1300 per claim was 88% of the creditor account’s value. If there was a cash portion, Fortress’ offering would be only around half of the creditor account’s value.

On the other hand:

We confirmed with a key figure buying up the claims that the cash portion was intact.

The voting rights column in the first photo shows the JPY portion as 751 million, while there are 601 billion voting rights for the BTC holders. I’m not entirely sure about this, but the vast difference in voting rights may indicate that the cash portion does in fact go to the BTC claimants.

The trustee converted ~60,000 BTC to cash, hence it is reasonable to think that the cash portion belongs to holders of the BTC claims.

One source claimed that the Fortress offer was undervaluing the real creditor’s account value because it didn’t include the cash portion.

Based on the above, the cash portion may be intact. With it, the immense risk reward ratio stands. Without the cash portion, the investment is not nearly as attractive, but still an opportunity to buy bitcoin at anywhere from a 10–50% discount (Fortress’ initial offer in 2019 was at a 50% discount to market price). For large capital, even small discounts mean significant dollar gains, which is compounded if Bitcoin achieves multiples of its current price in the next couple years.

Outcome

The Coinlab lawsuit does not seem to be completely resolved, but it seems there is an agreement between Coinlab, the trustee and Fortress that will allow the payouts to occur, without materially impacting the payout to claim holders. It seems that payouts are likely in 2023.

Ultimately, I decided not to engage in the opportunity. It wouldn’t be worth the paperwork, effort and uncertain liquidity profile for the small dollars I could personally allocate. Nor was it a fit for the venture fund I was working for at the time, whose mandate is to invest in startups, not distressed asset opportunities. For larger capital like Fortress, the work involved would be a worthwhile effort given the outstanding risk reward of 1.5x leveraged on BTC on the upside, great protection (80%) on the downside.

Before You Go —

To stay updated on new posts like this, follow me on Twitter (@dkSangyoon) and subscribe below!