I left my job at Draper Associates at the end of 2021 to brush up on coding through a bootcamp called Hack Reactor.

It was several years in the making. I’ve long wanted to code and build things. I was doing so at nights and weekends while working at Draper.

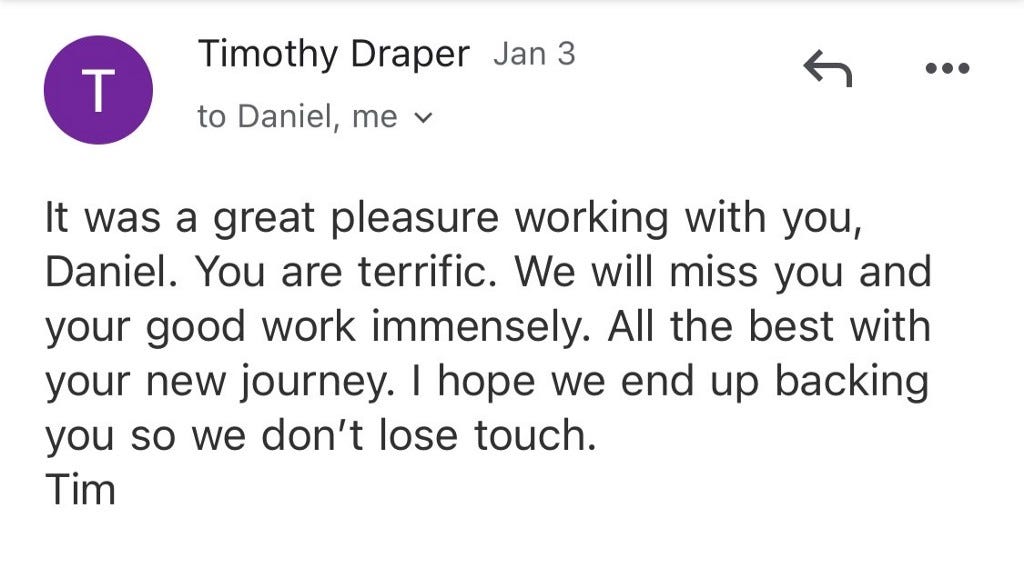

A quick shoutout to Tim Draper and the Draper Associates team. Learning one on one from Tim was a privilege. Watching his judgment, how to pick the weird, “otherish” companies with 1000x potential that nobody is looking at, humility and how to have a fun culture. I learned many things and feel grateful for my time there.

My Thought Process

As I am still in my 20s, I feel ok taking some risk. My risk tolerance will decrease with age, so I should do now what I’ll be less willing in 5–10 years.

Many people asked if it is worth it. After all, several of the big crossover funds had reached out and offered immense pay with additional carry, bonus and VP / partner titles (not that I find titles too meaningful) before I had even negotiated. Enticing for a 27 year old.

These inbound opportunities arose because crypto is now in vogue, and few people had crypto expertise, plus a background in Wall Street that these firms wanted. The typical MBA or Wall Street type would not have been in something weird like crypto in 2017, hence the lack of competition. Now that crypto is mainstream, I’m sure that the talent market will be much more crowded. The question I ask myself is, what is the next big thing that people aren’t paying attention to?

The younger you are, the more you should optimize career for max learning, not max forecastable EV (learning now increases unforecastable EV later) — Kyle Samani, Managing Partner at Multicoin Capital

Side note: I’m excited to be an investor in Kyle’s Multicoin Capital Venture Fund III. Since meeting Tushar and Kyle in college in 2015, I observed as they founded Multicoin two years later, and built it into a leading crypto investment firm. They achieved a 100x+ return on their first fund, considered the highest returning venture fund in history, by leading contrarian investments like Solana, Helium, Arweave and The Graph at the earliest stages. It has been both inspirational and reassuring to see folks in my circle become the top players in a space despite being both young and outsiders.

Coding Bootcamp Experience

I moved from San Mateo to San Francisco in order to be one block away from the coding bootcamp called Hack Reactor. As I was moving my boxes to the new apartment, I got a call. “The program is now remote due to the worsening Covid situation.” WHAT?! So I spent three months from January to March 2022, six days a week, 12 hours a day, coding in my SF studio apartment. Doing the program remote in my room was no fun, but such is life! Somehow, I emerged from the cave alive.

Here are some of the projects I built:

This cryptocurrency price tracker was my 2-day MVP project. I used React, PostgreSQL, Node.js, Express. Note — if you visit the project (link under the gif), the comment box does not work because I have not deployed the database since it costs money.

This was a group project with three other engineers. We built the front-end for an e-commerce website based on client specs. Some interesting learnings included using promise.all to make concurrent API calls, using local storage, and learning more CSS. Built using React, Express, Node.js and deployed on Amazon EC2.

The backend project was the most insightful for me, although there is nothing visual to show. I built a backend API that could scale to web server level at 3K requests / sec and sub 50 ms latency. It was interesting to learn how secondary indexes can optimize table lookup speeds from O(N) to O(logN), and to use a load balancer to horizontally scale servers. Learning how to deploy the backend was tricky. Built using NGINX load balancer, AWS EC2, PostgreSQL, and testing with loader.io and k6.

Now back to crypto.

Is Crypto Still A Good Bet?

Global crypto market cap is $2.5T. Global public equity market cap is $120T. That’s not even including private companies, or debt capital markets which are bigger.

You look at the composition of crypto holders, and it includes people in Argentina, Vietnam, or the Philippines. There are almost zero retail holders of typical SaaS stocks like Salesforce or Twilio there, but they own crypto. It is very possible that crypto capital markets will eventually replace US capital markets as the deepest and most liquid in the world. 2.5T vs 120T. Crypto is just getting started.

My Next Bet

Earlier, I posed the question, “what is the next big thing that people aren’t paying attention to?” In crypto, I think it’s gameFi.

GameFi today is where deFi was in 2018. Crypto games and guilds like Axie, Aurory, GuildFi and Merit Circle raised hundreds of millions of dollars each in late 2021, and now the tokens are crashing because of bad tokenomics. Just like the ICO boom of 2017 and subsequent crash in 2018. But the 2018 bear market was when the best deFi companies were built like Uniswap, Aave, Curve or Compound. The 2022 bear market will be when the best gameFi companies are built.

My bet is that the next wave of crypto users will come through gaming. The masses will learn about crypto through play-to-earn, trade the tokens on Uniswap, discover Ethereum and start holding Bitcoin. The reverse order of how people discover crypto today.

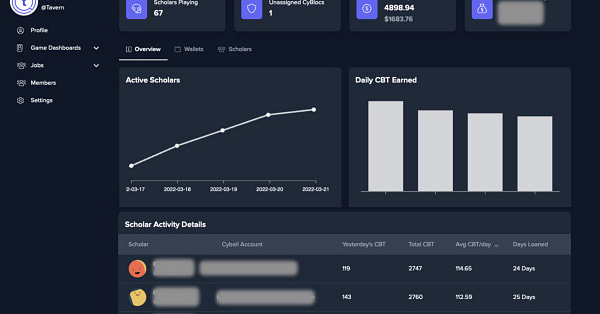

I’m working on a gameFi startup called Tavern. Tavern is building a two-sided network of gamers and guilds. Our first product, a dashboard for guilds to manage their scholars (aka gamers) for the game Cyball, amassed 170+ of the largest guilds as users, and 10,000 scholars onboarded in two months since launch. It now has over a third of global Cyball scholars managed through it. We launched it as a 3-person team, and will continue to stay lean until we find strong product market fit.

We subsequently raised our first round of ~$3.5M at 30M post this April as soon as I was out of bootcamp. We raised primarily from gameFi investors like Animoca, gumi Cryptos Capital, Y-Combinator OrangeDAO, OP Crypto, the founders of: YGG Guild, The Sandbox, Crunchyroll, Kabam, Rotten Tomatoes, Twitch, Youtube and other gaming angels and funds. Because we spoke only to gameFi investors, many of my friends at traditional venture and crypto funds don’t know that I am working on a startup. If we can find good product market fit, perhaps I will reach out to them and they might join us on this adventure. I am grateful to the investors who backed us in a bear market.

Whatever the outcome, I think I will learn a lot. Here’s to spending the next few years on the startup grind.

Leaving VC → Startup was originally published in The Startup on Medium.

Before You Go —

To stay updated on new posts like this, follow me on Twitter (@dkSangyoon) and subscribe below!