Match Group (MTCH) - New Position

A strong network effect business and market leader priced for zero growth, down more than 80% from its peak, with Elliott Management taking an activist stake

8/1 Update: Thesis playing out faster than expected. Three activists at once shakes things up fast. From $30 to $38 (+26%) since post two weeks ago. Should be going a lot higher if all plays out. “Match jumps most since 2022 after 6% job cuts, upbeat earnings”

7/18 Note: As I was writing this draft this past week, it was disclosed yesterday that a third activist, Starboard Value, took a stake and the stock has jumped from $30 to $35. Nonetheless, I believe the opportunity should be assessed independent of the now three activist investors involved.

I’ll point out that JC Penney (JCP) had Pershing Square’s involvement in 2010 and Kraft Heinz (KHC) had Buffett and 3G behind their mega-merger in 2015. Both ended up as failed investments.

Valuation

At $30, Match Group is trading at a ~$8B market cap and $11B enterprise value. It’s throwing off about $1B in free cash flow per year. They are expecting $1.1B in FCF in 2024.

The stock has cratered due to slowing growth, particularly at its biggest asset Tinder. It is slowing down Q/Q, but on a Y/Y basis, it is still growing.

“Revenue per payer (RPP) for the app was up 20% YoY in Q1 FY24 to ~$16.5. The trade-off has been a growing headwind on volumes: Tinder Payers fell 9% YoY in Q1 to ~9.7 million.” - TSOH Investment Research

Yet, it trades as if there will be zero growth going forward.

At a discount rate of 10% and $1.1B in FCFF going forward with no growth, we get an EV of $11B. That’s also the current price. Again, the market is pricing in zero growth going forward.

The multiples look much more reasonable today than they were 3-4 years ago:

Other Points

The business has 30% FCF margins. Margins may potentially increase even more if regulations start lowering the 30% gatekeeper fees that Apple and Google charge on their app store, which comprise most of COGS (see Epic vs. Google).

Seeing Bumble’s RPP at $26 vs Tinder at $16 tells me that there is greater monetization runway for Tinder. However, the falling payers is a concern to keep an eye on. I’m not surprised by the falling payers given Tinder’s subpar product reputation compared to Hinge and Bumble.

Hinge is also $400M revenue business growing 40% y/y and management expects it to be a $1B business within a couple years (half of Tinder’s revenue today).

I like that Elliott Management has built a $1B position in the company at an average price of $37 this year. Anson Funds, another activist, has also built a position this year. We get to buy at a lower price, and ride the coattails of the activists’ work with management.

Management has done a little over $1B in share buybacks in 2022 and 2023 combined. In Q1 2024 they did $200M (75% of the quarter’s FCF) and believes they will do $1B in buybacks this year. So they are ramping up the buybacks, using virtually all of FCF to do so. This means they are buying back 12.5% of the market cap in one year. Do this for four years and if prices stay where they are, they’d buy back half the market cap, which would mean doubling the share price, or a 20% annualized gain over four years, all else equal (in practice, stock-based compensation will put upward pressure on the share count of about $250M in 2024e, something to account for). They plan no acquisitions or dividends this year.

Risks:

Tinder revenue starts falling consecutively, driven by falling payers, and Match Group cannot maintain current levels of FCF.

Competition from Bumble and Grindr, which are growing faster.

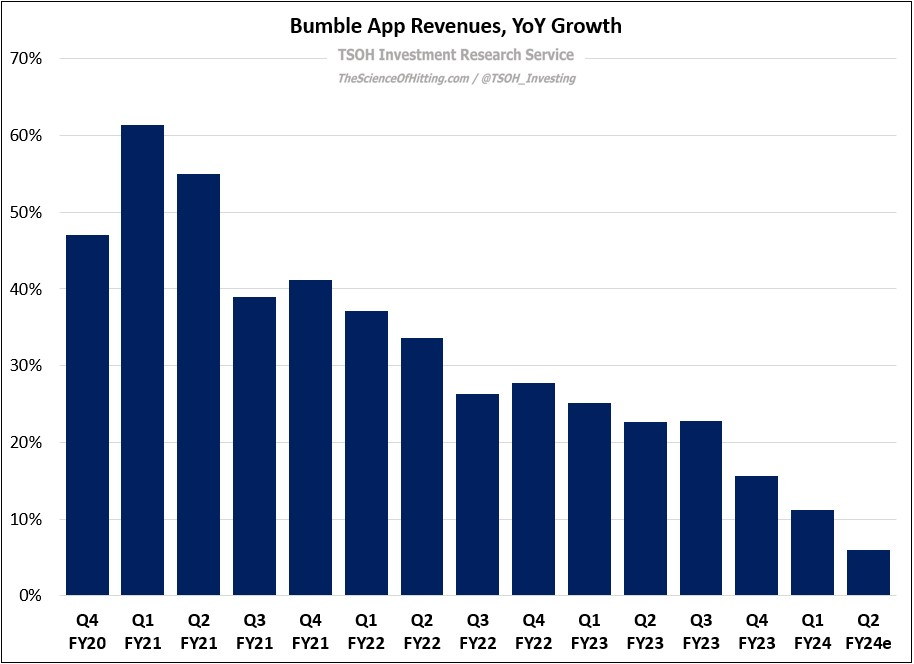

Market saturation: Both Tinder and Bumble are seeing slowing growth, as the below chart for Bumble shows. Bumble’s slowing growth comes from falling RPP (-6% YoY), despite growing paid users (+18% 1Q YoY) for a YoY revenue growth of 11% in 1Q24. This is the opposite dynamic of Tinder, who has rising RPP but falling payers.

Counterpoints to Risk: Why Sell-Side Fear of Market Saturation is Unfounded

Slowing growth for both Bumble and Tinder cause sell-side analysts to conclude that the market is saturated. This is wrong. My view is that with continued product innovation and marketing, there is immense room for growth. Let’s look at the data.

There are 700M connected singles excluding China, and 250M on dating apps. This is 1/3 penetration. Only 1/2 of US singles have used a dating product. Data is incongruent w narrative that online dating market is saturated.

Bumble says US dating is still concentrated in coastal regions. APAC penetration is 1/5.

41% of 18-34 year olds in North America have never used Tinder. Globally, 3/4 of 18-34 year olds have never used Tinder.

Gen Z is a growing user base that is less averse to online dating, so we have a structural tailwind.

The unique circumstance that let tinder scale at college campuses as a first mover is not replicable today. Today, competing requires a niche value prop. And trying to expand beyond niche alienates the existing user base.

Tinder and Hinge took years before monetizing; today, it’s hard for new entrants to have revenue uncertainty for that long. The market does not appreciate how defensible their business is because public market investors only see apps that have succeeded in scaling.

One reason that the bear narrative took hold is because MTCH does not report total users or churn rates, only payers. Let’s look at this.

Per a French app they acquired, we can assume churn is 12-15% which is very high (86% of users gone in a year) but thats the nature of dating app - it’s ok as long as CAC is low. Last 10-K showed CAC is down across their portfolio.

Super premium tier subscription Tinder Select is $500 / month. They are monetizing power users for power law dynamics. Apple vs Epic lawsuit revealed app store generates 54% of app store spend from 0.5% of users. Yes, payer numbers are falling, but sell-side is focusing too much on that without recognizing that revenue is still growing due to a focus on power users, and that there is still an immense untapped market that is hard for competitors to take.

Credits to great research by Bristlemoon (linked below).

Other Background:

Tinder was incubated at Hatch Labs, which was partially owned by Match which was owned by Barry Diller’s IAC. Sean Rad, the founder, received a $160K salary to incubate a startup at Hatch Labs in 2012. In 2014, Rad wanted renegotiate his ownership, so “Beginning in May 2017, Rad would receive a package of stock options worth 12 percent of the value of Tinder.” After lengthy negotiations, the valuation of Tinder was $3B. “At the $3 billion figure, Rad’s options in Match were worth about $360 million. He cashed in, selling all of his shares immediately. He bought a house in the Hollywood Hills for $26 million. He spent another $11 million on Ellen DeGeneres’s old ranch.”… Then Rad saw how his former co-founder and subsequent founder of Bumble became a billionaire. And Match’s valuation rise to $30B. He and his co-plaintiffs sued, and got a settlement of $441M at the end of 2021. The hyperlink above contains all the drama which I found interesting.

In 2015, Match Group did a “IPO” spinoff from IAC, where IAC continued to hold ~85% of Match shares and 98% of the voting power but now it could be publicly valued.

Shawspring Partners did a good short section (linked below) of how Tinder’s value was not recognized by the market at its IPO in 2015. Tinder was barely monetized and I don’t think anyone could have predicted it would grow to dominate Match’s revenue.

Match did about $1B in revenue then in 2015 (30% of today).

Additional Reading / Listening:

Investor letters from Shawspring Partners who held Match Group in 2020 and 2021 (and presciently sold before the crash post 2021), with brief but insightful mentions of the company:

Understanding the history of Match Group, its ownership by IAC, acquisition of Tinder, and spinoff as a separate entity:

Finally, the below three articles are very good research coverage on Tinder’s last few quarters but it is paywalled. While he has exited Tinder this quarter due to concerns around market saturation and Tinder’s ability to grow, my thesis rests on the fact that the business is priced for zero growth, while revenue continues to grow (despite falling payers). I also believe structural tailwinds from smartphone and digital dating will make growth over the next 5 years more probable than the opposite.

Great read!